( The first three sections of this essay have been deleted because they are no longer relevant).

3.0. What Is the TRUTH About Our Natural Resource Wealth in Kenya?

Millions of Kenyans have to come as accept as a "fact" the allegation that we are a very, very poor country that has practically no natural resources to speak of.

There is a South African-based website called

which describes itself as "Africa's leading business, travel and tourism website and a world travel, mining, energy and trade site".

which describes itself as "Africa's leading business, travel and tourism website and a world travel, mining, energy and trade site".This is what it has to say about our country:

"The East African republic of Kenya has no known oil or gas reserves. The Kenyan government is encouraging foreign interest in oil exploration and there is a modest upstream oil industry. It is endowed with other energy sources including wood fuel, coal, solar and wind power, much of which is untapped. The country's commercial energy needs are supplied by electricity, coal, fuel wood and oil-derived products."

You know something folks?

That, is ONE BIG FAT FRIGGING FALSEHOOD.

My task, for the remainder of this essay is to back up my assertions with facts and figures that are independently verifiable.

Let us begin with a snippet from a story that was filed by Voice of America on May 1, 2004:

"New evidence of possible oil reserves in East Africa, stretching from Madagascar to the tip of Somalia, has prompted several major oil exploration companies to begin drilling in the region.

East African governments are eagerly cooperating with the companies, expecting to share in future oil revenues that could significantly boost their impoverished economies. But critics say there is also much potential for the oil money to add to corruption in the region, and make the countries even poorer.

Reviewing data recently taken from rock samples off the coast of Pemba Island in Tanzania, British geologist Chris Matchette-Downes says East Africa has the potential to become what he termed the world's hottest oil exploration frontier in the next few years.

"I took samples from the Pemba oil seep and extracted samples from a number of wells in Tanzania and one well in Kenya," he said. "There are indications that [there] is an active petroleum system somewhere that hasn't been found yet. That leads me to think there is a massive soft rock system that runs all the way along the coastal strip of East Africa, probably into Somalia and maybe all the way up to Yemen. We now need to find the traps and hope the oil hasn't leaked out or has been lost in another way. But I'm convinced we will find significant finds."

That enormous optimism is shared among more than half a dozen oil companies currently surveying and drilling along East Africa's coast.

At least three companies, including oil giant Royal Dutch Shell, are searching off the coast of Tanzania. Other companies from the United States, Britain, Australia, Malaysia, and Denmark are exploring offshore in Kenya, Madagascar and Mozambique.

The interest is new to a region that was long thought to have little potential for an oil boom. Previous explorations in the 1970s and '80s showed some oil and natural gas deposits but they were not considered to have any commercial value.

Further oil explorations were put on hold while international companies flocked to discoveries made in West African countries like Nigeria and Angola.

While West African fields are helping to meet U.S. and European demand, energy companies say they are hoping oil from East Africa will meet the ever-increasing demand from across the Indian Ocean in China, India, Japan and other parts of Asia.

In Kenya, the renewed search for oil has hopes soaring that the country could soon join the ranks of Africa's major oil producers and reap enormous financial rewards. Kenya relies mainly on tourism and commodities exports for revenue and has long been looking for new ways to emerge from decades of poverty.

A senior geologist at Kenya's National Oil Corporation, Eunice Kilonzo, says the government believes that if oil is found here, it could single-handedly transform the economy.

"For example, in Sudan, they are producing about 280,000 barrels of oil on a daily basis," said Eunice Kilonzo. "This translates to about $800,000 daily for Sudan. Imagine that being reflected in the Kenyan budget, imagine what impact it will have on our economy if we were to find oil."

The thing is Ms. Eunice Kilonzo you and all your colleagues KNOW that oil was found in Kenya AGES AGO!

Let us add some nyama to those mifupa:

"...Kenya currently does not produce crude oil, and must import all of the 57,000 bbl/d it consumes (see Table 3 ). Previous exploration attempts for a domestic source of oil have met mostly with disappointment. However, with the most recent round of exploration performed in the later half of 2003 by Australian-based Woodside Petroleum, Pancontinental, and UK-based Dana Petroleum, and others, hopes are high that the renewed search for oil in Kenya may enjoy greater success. Most Kenyan oil companies import their oil from Abu Dhabi's National Oil Corporation (Adnoc), although in December 2002 a large consignment of oil from Dubai was rejected by Kenya on the grounds of high sulphur content, causing considerable short-term fuel shortages throughout Kenya. Sudan has also been considered as a potential alternative source of oil imports, although, until a peace agreement in the country is concluded and fully implemented, such a possibility is thought unlikely. The Kenyan government has spent about $169 million exploring for oil and natural gas over the past 15 years. Over 30 wells have been drilled so far, but without much success.

In April 2001, Dana Petroleum was awarded several production-sharing licenses by the Kenya.The blocks - L5, L7, L10 and L11 - situated in the Lamu Basin and represent one-half of Kenya's available offshore concessions. In May 2003, Woodside Petroleum, acquired a 40% stake in those blocks from Dana. Dana will retain a 40% holding, with the remaining 20% stake held by Star Petroleum, a subsidiary of Global Petroleum. Woodside is now the operator of the blocks. A seismic study was initiated in the third quarter of 2003, after which two exploration wells are scheduled to be drilled. In April 2002, the Kenyan government executed agreements that grant exclusive exploration rights of blocks L6, L8, and L9 to Pancontinental Oil & Gas (60%) and a UK-based Afrex Limited (40%). In August 2003, Woodside farmed into the three blocks, taking a 50% operating stake. Afrex will now hold a 30% stake, while Pancon will hold the remaining 20%. In return for its entry, Woodside will undertake the seismic work for the three blocks. A 3,488 mile survey across all seven blocks was completed and sent for data analysis during the fourth quarter of 2003 with results to be available in early 2004. Work is also continuing by the new Kenyan government of President Kibaki to introduce a New Petroleum Bill designed to help better regulate Kenya's petroleum sector. On November 21, 2003, as a sign of support for the government's reform and anti-corruption efforts, the International Monetary Fund (IMF) voted to extend a new program of loans worth $252.75 million dollars over three years in a new poverty reduction drive in the country. Previous IMF programs in the country were suspended in December 2002 due to concerns at corruption and lack of commitmnet to reform by the previous government of President Daniel arap Moi..."

SOURCE.

Prospecting for oil in Kenya, as you can see by clicking on this link, has been going on from as far back as 1975 if not earlier:

I want to introduce you to a geological company called:

Humble Geochemical Services which is a division of Humble Instruments & Services, Inc. They are to be found in a town named after the company itself- the exact street address is 218 Higgins Street,Humble, Texas USA 77338.

They are so MODEST as you can see..

Well, I somehow dug them up,yaani unearthed (pun intended), excavated their site through my sheer morbid curiosity.

You know what they did not too long ago?

They made a nice little brochure about this ka-little, small small jamhuri or is it taifa hugging the Indian Ocean called...you guessed it-Kenya.

So what do these Humble geological Texas dudes in their Stetsons and Cowboy boots have to say about Kenya? We do not have a rodeo, hardly touch chili corn carne or rattlesnake soup and definitely did not cast a ballot for Dubya (at least not many of us, because they are in fact 5 or 6 diehard Kenyan born Black Republicans outneocons and outcooning the neocons of the National Review).

Kwani, wasomaji, mshachanganyikiwa ama vipi?

When you think of Texas what is the other thing you think about?

No, not

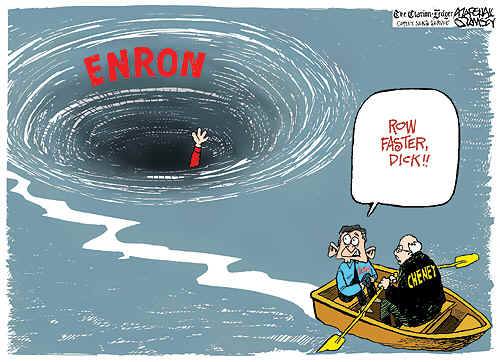

ENRON.

And forget about the bat-eared

Ross Perot for a second will ya?

Repeat after me....

M

give me an

A

F give me a

U

T give me a

A!!

Together, let's say it:

M- A- F- U- T-A-!!!

Here is what Humble informs its shareholders in its 2005 brochure titled, Kenya:Land of Oil Opportunities:

"Humble Geochemical Services has 2 studies available for purchase in Kenya. These studies include the Lamu Basin and the Lokichar (Lotikipi) Basin in the Lake Turkana area of Kenya. Work is currently underway for a new study in the Anza Basin.

Recent work on the Shell Loperot #1 well demonstrates the presence of a 300 m. thick lacustrine source rock in the Lokichar Basin. The Loperot #1 well was drilled as a stratigraphic test and, even so, crude oil was recovered from a DST in a shallow interval and a deeper interval with oil shows was not tested. Oil was also recoverd in the Anza Basin and correlates to oil found in the same rift system in southern Sudan. The Lamu Basin has offshore oil possibilities similar to that for offshore Tanzania to the south."

A blogger friend of mine told that posting a graphic is equivalent to writing three pages:

Sedimentary basins and provinces of Kenya.

The Lokichar Basin oil(in the Lake Turkana area) potential is demonstrated by geochemical logs of the Loperot #1 stratigraphic test that recovered a DST oil.

Lokichar Basin – Lobster Prospect

The total petroleum potential of the Tertiary source rock found in the Loperot #1 well is comparable to the prolific Cretaceous source rocks of Sudan. The Lobster prospect developed by NOCK provides an immediate drill site with high likelihood of oil charge.

Oil and gas shows have been encountered in the drilling of 14 wells in the Lamu Basin. The primary risk is source, but an important Eocene source rock has been documented. Further, suggestion of marine oil prone sources possibly Cretaceous or Jurassic are suggested from seep analyses in Kenya and Tanzania for offshore areas.

SOURCE.

There is also one little covered story that I have been tracking since it came across the news wires as a flash in June 2004. It concerns off shore oil prospecting around the northern Kenyan coast. For some weird reason, it was given some very prominent coverage by a Namibian newspaper.

A couple of months after that Dana Petroleum Plc confirmed all this on their website.

About a week or so, yes in mid July 2005, when Kenyan government goons were clobbering peaceful pro-democracy, anti-Kilifi Draft demonstrators in Nairobi, there was a quiet update on that story that anyone with a yahoo account may have glanced at-and ignored...

Dana Petroleum's partners in Kenya is an Australian company called Global Petroleum and they are to be found on Level 9, 46 Edward Street Brisbane, Queensland, Australia 4001. Their Phone is +61 (7) 3211 1122 and Fax is: +61 (7) 3211 0133. John Armstrong is their Executive Chairman; Peter Blakey is Joint Chairman along with his name sake, Peter Taylor; whie a THIRD Peter Dighton and Mark S. Savage make up the rest of the directors of the company.

You can read the actual reports on Kenya from Global Petroleum by clicking here and come over here for a PDF file of a Power Point presentation highlighting their Kenyan prospects. here is their latest Quarterly Report that was released on 28 July 2005.

Wall Street Reporter recently interviewed

Executive Chairman John Armstrong:

WSR: Could you begin with an overview of the company?

GBP: Global was listed on the Australian Exchange in 2002, and its overall goal is to take a responsible view in regard to the investment of speculative funds in the oil and gas sector.

WSR: Tell us more about some of your projects and properties, and what stage you stand in terms of exploration, drilling, development, etc.

GBP: We have two flagship project areas -- both deepwater -- one off Kenya and the other to the east and southeast of the Falkland Islands. Our offshore Kenya project is with Woodside as operator and with a U.K. company, Dana. In that one, we have 20% equity, and the costs associated with our equity is fully carried for the current program of seismic and the drilling of two deepwater wells. Woodside as the operator there plans to begin drilling in the H1 of 2006. I guess the roadmap to that one is there are some very large prospects offshore in a geological environment that has never been drilled before, and some of them have some interesting attributes that attracted us to that particular thing. That is perhaps the headline project, which we have had for a couple of years. The other is Global’s 14% share holding in a ₤95.6 million AIM-listed company named Falkland Oil and Gas Limited (FOGL), and that company has a huge acreage position to the eastern side of Falkland Islands. By huge I mean 83,000 square kilometers, or the equivalent of 276 North Sea blocks, and it’s a piece of the offshore that has never been explored for oil and gas, and yet the rocks are the right age, in that they are tertiary and cretaceous. Those types of rocks held most of the world’s oil in different places around the world. And, as I said, it has never been explored, and Falkland Oil and Gas is involved in a massive seismic program now with over 10,000 kilometers of seismic, and via reports that it’s made, it’s finding quite a large number of very encouraging opportunities. We have something like 100 plus leads, and some of the key leads are 300-500 square kilometers in size and all going well, we hope to have about 20 drillable projects evolved over the next 12-18 months with the first well in 2007.

WSR: How important are strategic alliances and joint ventures for this company, moving forward?

GBP: I think very much so, because we are a small company as you know, and the strength of our Kenya project lies in having Woodside as 50% equity holder and operator, and they bring their technical muscle to the party there. In the Falkland’s project, this was a very new one because we only initiated that Falkland Oil and Gas Company last year, and we only acquired the additional 50,000 square kilometers in December last year, on top of the original 30,000 square kilometers. FOGL holds an average of about 90% equity in the two areas. So, we are not quite up to the stage where we want to introduce another company yet, but with the size of the acreage as time goes by and we need the friendship of someone with deeper pockets and technical muscles than we have -- we will be seeking to introduce another party there, but not just yet. That said, in the past three months, we have had senior level inquiry about the Falklands from some of the largest majors in the world which have obviously run a ruler over the high prospectivity and large-scale potential of our licence areas.

WSR: What differentiates this company from others in the industry?

GBP: Fundamentally, we are a microcap company with control of, or stakes in, mainstream oil and gas exploration assets with huge appeal and upside. That differentiaties us. We have also undergone a massive step-change in the opening six months of calendar 2005 -- to such a degree that we are now positioned to participate in drilling programs on targets that are potentially company-makers, in under two years, through our Kenya or Falklands interests. That

differentiates us from companies of like size or even larger ones, in fact. If you look inside the Kenya and the Falkland projects rather than those projects each having one or two possible drilling targets, I think the numbers of targets in Kenya would be 10 to 20, many with attractive characteristics. And in the Falklands, that project began with eight potential drill targets in the acreage that are held, rather I think the seismic that that company is conducting is revealing that there are several play types in vast areas of interest where we now have, as I said, more than 100 leads. And each area of interest in turn has several key leads in it so it is a good cross-section. So, I think what distinguishes us is that we are a company with sound position to drill tertiary-cretaceous areas where there are literally dozens of opportunities of different play types. So, we have not only the range of opportunities, but the risk, of course, is spread sensibly so that drilling of one type doesn’t necessarily negate the opportunities in other places.

WSR: What can you tell us about the key players onboard, the management team at Global Petroleum?

GBP: I think the strength of the company at the moment is centered around the board of the company. My background is 35 years in the industry, initially for ten years with UNOCAL in Indonesia, and then about 20 years with building Santos up (an Australian company) from I think a market capital of about AU$1 billion to about AU$4 billion. The other directors are a lawyer who is experienced in the industry, a fellow called Peter Dighton; two gentlemen from the U.K., Peter Blakey and Peter Taylor, who in turn, I think, were involved in the formation of companies like Hardman, an Australian listed company, and Dana, the U.K. one with us in Kenya. The two Peters were involved in the formation of those companies, and the fifth member of the board is Mark Savage, a financial guy who resides in the U.S.A. So, we have got an experienced Board, and that’s the strength of the company at the moment.

WSR: Do you feel the investment community understands this company and the direction here, given the current stock price?

GBP: We are undervalued, I’d say, and one of the reasons we took the company to the AIM market in London was to develop Global into a company not only with a sound portfolio of projects, but to give it access to appropriate markets and appropriate capital markets as well. So, the listing on AIM took place in this year, and we’ve got to develop that relationship further yet. It is pleasing to see that some external critiques of Global have us at being undervalued and worth potentially 5-6 times our current on-market values, subject to drill success. And you have to remember, the historical deepwater success rate is 20-25%, or one in four or one in five wells proving commercial. That’s a very strong upside, so it’s little wonder Global is starting to attract the attention of the dominant international players.

WSR: In closing, let’s recap a bit. Why should investors consider Global Petroleum as a long-term investment opportunity?

GBP: We have got a very sound portfolio of very high upside projects. We are carried through two wells, totaling about US$65 million in cost, in Kenya, and we’ve got a high shareholding position in an emerging company, Falkland Oil and Gas Limited, which is developing numerous prospects and projects. In addition, we represent very high potential upside returns for the shareholders that invest in us now, in a timeframe of less than two years and on plays that are large-scale.

4.0. The Kibaki-NARC Regime Has Been Very Economical With the UKWELI

My fellow Kenyans:

Have you noticed something FISHY?

Only one?

I can think of several.

First of all, isnt it INTERESTING that all these oil finds are in PRECISELY those regions and parts of Kenya that have been completely marginalized for the last one hundred years?

Secondly have you noticed that this NARC government, these ladies and gentlemen who used to SCREAM AT THE TOP OF THEIR LUNGS(like that) about "Transparency, Accountability and Good Governance" have kept their mouths completely

ZIPPED.

Can you imagine the GALL:

Kenyans from northern communities like the Turkana, the Pokot, the Rendille, the Sakuye, the Borana,the Somalis, the Gabra and the Samburu are tearing each other apart, slitting open the throats of each other's kids in a desperate fight against extinction, subsisting in PRIMITIVE 19th Century precolonial conditions while their so called "Government" in Nairobi is busy inking deals with Western multinationals from as far off as Australia to come and exploit and cart off super profits from those very communities? Rural and coastal Kenyan communities are wallowing in poverty while they LITERALLY sit on a reservoir of abundant wealth??!!!

Isn't it a national SCANDAL that we the Kenyan people DO NOT KNOW that we are probably POTENTIALLY one of the RICHEST COUNTRIES in Africa and yet our President still blames the famine that we warned about last year on the freaking WEATHER?

What kind of conmen and conwomen are these guys?

When are they planning to tell Kenyans about all these megalucrative oil deals?

To their credit, the foreign corporations HAVE BEEN COMPLETELY TRANSPARENT. All I had to do was to go to their respective websites and all the information was right there.

You know something:

I smell a very, very very BIG

PANYA.

Here are my SUSPICIONS:

1. The former Energy Minister Nicholas Biwott as well as the current one, Simeon Nyachae have been ANXIOUS and DESPERATELY to be part of the Kibaki cabinet because they want to position themselves to GRAB the natural resources that belong to the people of Kenya- especially those aforesaid marginalized northern communities;

2.This whole MEGA thing, apart from being an OPENLY TRIBAL SUPREMACIST outfit, is a strategem for the Central Kenyan comprador bourgeoisie to use their andu aitu state connections to LOOT and PLUNDER same said wealth in much the same way that the Dawida and Mijikenda people were robbed of their ruby, land and tourist foreign exchange revenue by the earlier generation of Kenyatta and Moi led wabenzi jambazis. This is an absolute outrage and disgrace!

4. Other fractions of the comprador bourgeoisie from other regions and nationalities- the Raphael Tujus, the Moody Aworis, the Mukhisa Kituyis, the Musikari Kombos, the Kirwas, Limos etc also want to line up at the trough to gorge on the coming prosperity of Kenya powered by these projected oil revenues. Can you imagine this kind of uchoyo, ubinafsi na utapeli?!

5.The refusal to let the Maasai, the Dawida and other communities deal with the land issue in a timely, just and equitable manner is yet another manifestation of this robber baron mentality of the Kibaki-NAK gang!

6. The Moi and Mwai governments invested so heavily in the Somali and Sudan peace processes not because THEY GIVE A HOOT for those countries but rather because Somalia and Sudan have both tons of UNTAPPED OIL REVENUES and the Kenyan elite want to be the sub-imperialist brokers for the United States, China, Australia and all those Western countries and their associated transnational corporations.

7.The abrupt about face over the Tiomin Titanium mining saga by the Kibaki team, who made all kinds of promises to the Digo people, the Coast Mining Forum, the Kenya Human Rights Commission and other community, environmentalist and social justice groups is triggered by the same tumbo mbele wananchi nyuma attitude. For a detailed examination of Tiomin Titanium issue please visit this link over at the Kenya Socialist Democratic Alliance site. Here is another link to an essay I wrote about four years ago on the same subject.

8. These shady shenanigans around petroleum, titanium, land and other natural resources "deals" and "Mega" conglomerations provide for me the ECONOMIC SMOKING GUN that reveals one of the MAIN MOTIVATIONS behind the BLOCKING of the Bomas Draft and the pushing of the Kilifi Draft. You can safely BET that the forces pushing the Kilifi Draft are lining up, ganging up to loot our natural resources and shortchange Kenyans of a chance of climbing out of the morass of poverty.

5.0. How Can Ordinary Wananchi(Especially the Turkana, Pokot, Wagunya, Waswahili, Wadigo, Wasomali,Waborana, Wagarri, Wagabra, Wasakuye,Wadawida, Wamaasai) Benefit From Kenya's Untapped Potential?

(a) Information is POWER. I consider the researching and writing of this particular essay as a PATRIOTIC DUTY. Obviously, if Kenyans are waiting for the Kibaki regime to give them the 411 about how much oil, gold, titanium, ruby and I know what else, we will be waiting for a very long time. I consider what the current Kenyan government is doing WORSE than what the wabeberu did at the close of the 19th Century- at least those imperialists did not make any bones about the burning and the looting, the raping and the killing, the landgrabbing and the repatriation of profits. The NARC government politicians tout themselves as members of the so called "Second Liberation"? What liberation? These thugs are selling us a new to the 21st century monopoly capitalist barons- because their corporate "partners" have guaranteed them SOME CRUMBS for SELLING US OUT.

(b)It all comes back to the URGENT NEED for a democratic constitution which governs how our natural, human, intellectual and technological wealth can benefit us FIRST as Kenyans, before they line the pockets of some miners in Brisbane, Australia and Toronto, Ontario. That constitution has been written over the last fifteen years with the blood, sweat and lost lives of many patriotic wananchi. That draft came out of the Bomas process as is known as the Zero Draft. Any other caricature of a katiba will entrench us further and further into the abyss of neocolonialism and imperialist recolonization.

(c) Kenyans as a whole and the northern communities in PARTICULAR must make sure that they BECOME THE MAJORITY SHAREHOLDERS of any petroleum and resource based business and investment ventures that see the light of day after all the prospecting is done. Consortiums of DEMOCRATIC minded Kenyans abroad should make a point of buying shares in these companies so that the can use their voting and other rights as shareholders to ensure that things like environmental impact assessment studies, equitable and ethical remuneration and fair labour standards govern these future oil corporations.

(d) Questions must be raised in parliament about the lack of transparency in these shadowy deals.

(e) In regards to a wider and more sustained trajectory for self-sustaining national development in Kenya, see my recent essay entitled, "Social Prosperity is A Distinct Possibility in Kenya".

Hopefully there will be a follow up to this digital intervention.

Onyango Oloo

Montreal

PS: Check out this article from the East African

5 comments:

Feedback from the Mashada Forum:

Forum name

Politics

Topic:69271, RE: Why is NARC Not Levelling With Wananchi About Kenya's Oil Wealth?

Posted by Kamale, Wed Aug-03-05 04:12 AM

Oloo,

Early last week an article on the presence of 'commercially viable' deposits of oil appeared in the local media. Nothing big, and only those of us who scour the news pages may have noticed the significance of that article.

But nothing struck me more than Legal Notice No. 82 dated 22nd July, 2005. This was titled PROCLAMATION BY THE PRESIDENT OF THE REPUBLIC OF KENYA and dealt with the redifinition of Kenya's Exclusive Economic Zone for the 'purposes of exploring, exploiting, conserving and managing the natural resources........of the water column, sea ben and the sub soil"

This proclamation was very definitive (inlding longitudes and latitudes) on how Kenya's territorial borders and the EEZ at sea align with Tanzania and Somalia, and this was the first time this was being done since the earlier Proclamation by Kenya.

In my view, this must be with the intention of setting up a legal basis for claims to the wealth underneath the sea in the blocks the oil exploration is taking place.

I will not dwell on whether lies are being told (or the silence is deliberate), but I can say we are on the same wavelength when we say that something big is on its way to Kenya!

By the way, good research!

Comments from the Kenyan Discussion forum on www.rcbowen.com:

*********************

OO i beg to differ with you on this...

From: PegAsus - Wed, Aug 03, 8:33 AM

On your essay on oil-Kenya's political stability alone and there survival as presidents was on line by continued instabilty in those countries. Oil revenue was a secondary factor if it was ever a factor.

The Moi and Mwai governments invested so heavily in the Somali and Sudan peace processes not because THEY GIVE A HOOT for those countries but rather because Somalia and Sudan have both tons of UNTAPPED OIL REVENUES and the Kenyan elite want to be the sub-imperialist brokers for the United States, China, Australia and all those Western countries and their associated transnational corporations.

**********************

"Ilmei Triangle" has cost Kenya billions of Ksh.

In response to OO i beg to differ with you on this... posted by PegAsus

From: Anonymous - Wed, Aug 03, 9:28 AM

The Republic of the Sudan has the political will, business savvy, the social history (since the 4th century) and Port Sudan to broker their own deals with outsiders such Saudia, the United States, China, Korea, Russia, Australia, and other european nations.

Sudan has never needed the two East African nations to intercede on their behalf in any way, shape or fashion. It's the Kenyan and Ugandan adminstrations that have invested a great deal in the peace negotiations between Khartoum and the southern factions, so as to have a semblance of security and regional stability on their northern borders, such as Trinyeti, Nemi Triangle and "Ilemi" Triangle.

Sudan is a 'Northern' African nation, boedering the Red Sea, it's slightly more than one-quarter of the size of the United States. Khartoum does more business with Egypt and Libya than it does with Eriterea, Ethiopia, Kenya and Uganda combined. While it's other neighbours like Chad, C.A.R. and the Democratic Republic of the Congo are considered a liability in many ways.

On the other hand, the 1982 coup would have succeded had it been hatched in Nairobi and carefully organized in Southern Sudan.

***********************

May I Add

From: Yatima - Wed, Aug 03, 9:40 AM

It also explains why MOI and his cohorts bought Mobile and renamed it KOBIL (Kalenjin Oil Billionares). It also explains why Biwott was the longest serving minister for Energy.

Yatima

***********************

Yatima, you are ignorant!!

From: _ - Wed, Aug 03, 9:48 AM

The Mobil franchise in Kenya was up for sale. Moi purchased it from the Delware owners. Back then, then oil explorations had not even begun. Moi owned his Mobil gas station in Nakuru way before he became president.

your ignorance amazes me by the day yatima!

*****************

Comments from the Nation Newspapers Discussion Forum( Politics Section)

ps: do not pay too much attention to where the posting are allegedly coming from, for instance "malaysia" or "afghanistan":

*********************

RobertKormoczi on 03/08/2005 at 3:44am - IP Logged

Gold Member

Malaysia

20/01/2005

700 Posts

It makes perfect sense regarding Sudan and Somalia, one point I always find funny is that when people believe Kenya to have spend massive amounts on those peace brokering deals, and it could also explain the latest killings somehow.

But Kenya having substantial oil reserves? I'm just not sure what that might lead to if. Prosperity for all or a mad scramble for power by a few with all the usual violent attachments.

**************

Message posted by chieth ogwaI on 03/08/2005 at 3:50am - IP Logged

chieth ogwaI

Standard Member

Afghanistan

03/08/2005

9 Posts

Kenya's wealth belongs to Kenyans an not Kibaki and the Mega group. Onyango's blog tells me why Kibaki is not ready to prosecute Biwott.

More from the Nation Forum:

mosaisi

Gold Member

01/03/2004

1351 Posts

Oloo that was another good one.

To add on to what you said, I will like to remind us of Westmont Power (K) Ltd. This is one of the Kenya's Enrons. At one time, they collaborated with Kengen to turn off power in order to get an excuse to hike tariffs. When one assistant minister called Atebe Marita was asked why Kenya was experiencing power blackouts, he said "electricity can be sick just like anybody can be sick." What an answer! In a related question he answered, "water levels are low at Turukweri George (sic)"

If I am not wrong, Kenya Power's Guchuru had interests in Westmont Power while he was the head of the company. Gichuru teamed up with an offshore company called Lynwood Development Ltd and Bank Indosuez to defraud Kenyans of Millions of dollars.

The other player that you missed is IberAfrica (EA) Power Limited. It was in the same game as Westmont. This company made billions from inflated power tariffs. How on earth can a company sell 1KW of power at $395!

Last but not least you seemed to have left out Energem. This is the latest entrant into the Kenyan energy sector. Interestingly, they came in when their business partner was the minister for energy. Their track record on human rights is not clean at all. When you talked about chaos that may emanate from marginalized Kenyan communities, I remembered of the Sierra Leone diamond wars where Energem was deeply involved.

Most of politicians you pointed as positioning themselves to exploit the energy sector are industrialists and mac-farmers. They can benefit a lot from cheap energy. To me they will be on the bottom of my suspects' list. On the top of my list I will have ministers who are already in the energy sector. I know this will rub many people on this forum the wrong way but it one of the logical ways to look at it.

Message posted by tupambao on 03/08/2005 at 10:40pm - IP Logged

View tupambao's Profile Search for other posts by tupambao Quote tupambao

tupambao

Gold Member

Neutral Zone

01/03/2004

142 Posts

whenever I read something about oil exploration in Kenya I always get this funny fealing. My dad used to work for Kenya Pipeline, so I can say I know some stuff about oil and the happenings in KPLC. I agree with Oloo that there is alot of corruption in the Oil / energy industry, but which country isnt corrupt when it comes to oil?

What is wrong with Kenya earning money from the oil wealth of the neighbouring countries? This is common practice worldwide and I do not see anything wrong with any ruling Kenyan government investing in peace negotiations in warring neighbouring countries with the prospect of earning money for Kenya (I know here is where the possibility of corruption lies but still some money will come to Kenya if not a few Kenyans will be working in those countries). Once Rwanda, Uganda, South Sudan and maybe Ethiopia start pumping oil, lets hope they will use Mombasa as its oultlet as this will bring alot of business for the port...Mombasa might just become the next Rotterdam

There is a difference between knowing your potential and having the potential. Kenyans know that there is a high potential to find oil in Kenya... should they be told about it? I dont think its necessary. It will just create alot of excitement and push expectations up so that I am sure people will stop working and expect money to be poured into their laps once Kenya starts pumping oil. I remember former president Mo1 visiting oil exploration drills in the Marsabit region in the 80s. The guys had found oil and there was alot of excitement, but it wasnt enough for exploitation... and no one spoke of oil finds again. So the current Government holding its cards close to the chest is actually good. Let them find oil and determine how big the reserves are then they can announce it and start pumping. Then see the peoples reaction.

I personally wouldnt want Kenya to find oil, because we are a greedy people who find nothing wrong with getting rich quickly at all costs even if it is for a short time (at least I enjoyed it...as people say). The model of Kenya handling other governments oil is the one that I find more atractive, because it will force us to be innovative, cooperative with our neighbours and keep up with offering better services.

Any way it goes once we find oil, we will definately have our own Mikhail Khodorkovsky. All I hope is that Kenyans will realise that it will take about 10-15 years before we start seeing the fruits (read surplus) of Oil money being pumped from our backyard. (This is the amount of time it takes to pay back all the money borrowed to build the infrastructure) Though the current prices might cut that time to about 5-8 years.

Are you a business man or woman? Do you need funds to start up your own business? Do you need loan to settle your debt or pay off your bills or start a nice business? Do you need funds to finance your project? We Offers guaranteed loan services of any amount and to any part of the world for (Individuals, Companies, Realtor and Corporate Bodies) at our superb interest rate of 3%. For application and more information send replies to the following E-mail address: standardonlineinvestment@gmail.com

Thanks and look forward to your prompt reply.

Regards,

Muqse

Post a Comment